The airline sector is a great addition to any investor’s stock portfolio. Owing to the Covid-19, the airlines’ stocks are trading at an attractive valuation. By investing in quality airline stocks, you will get a fruitful return when you stay invested for the long run.

Before investing in airline stocks here are the 3 questions you should ask yourself.

Are your family insured?

Before investing you should buy an insurance policy to tackle health emergencies. When you are insured you don’t need to sell stocks that have in your portfolio when any medical emergency comes at your door.

Have you created an emergency fund?

When you create an emergency fund that will cover all the household expenses namely, grocery bills, utility bills, and even Netflix subscription charges for the next six months, you may move to invest. If you have not prepared one then first of all create an emergency fund before making an investment.

Have you prepared an asset allocation strategy?

Don’t invest solely in the airline sector. Instead, diversify your portfolio across 3 sectors when you are going to invest in 7 different stocks. This will minimize the risk profile.

How to pick best Airlines stocks for a consistent return

After choosing the sectors where you wish to invest, you need to pick the best stocks for consistent returns. In order to pick the best stock, you should check out the following parameters of the company.

Parameter #1. Revenue – Revenue or net sales of a company should be constant for at least 5 years. You may check that the company has been generating sales growth annually during the last 5 financial years of at least 10%.

Parameter #2. Net Profit – The net profit of a company increases at least 15% on a year-on-year basis.

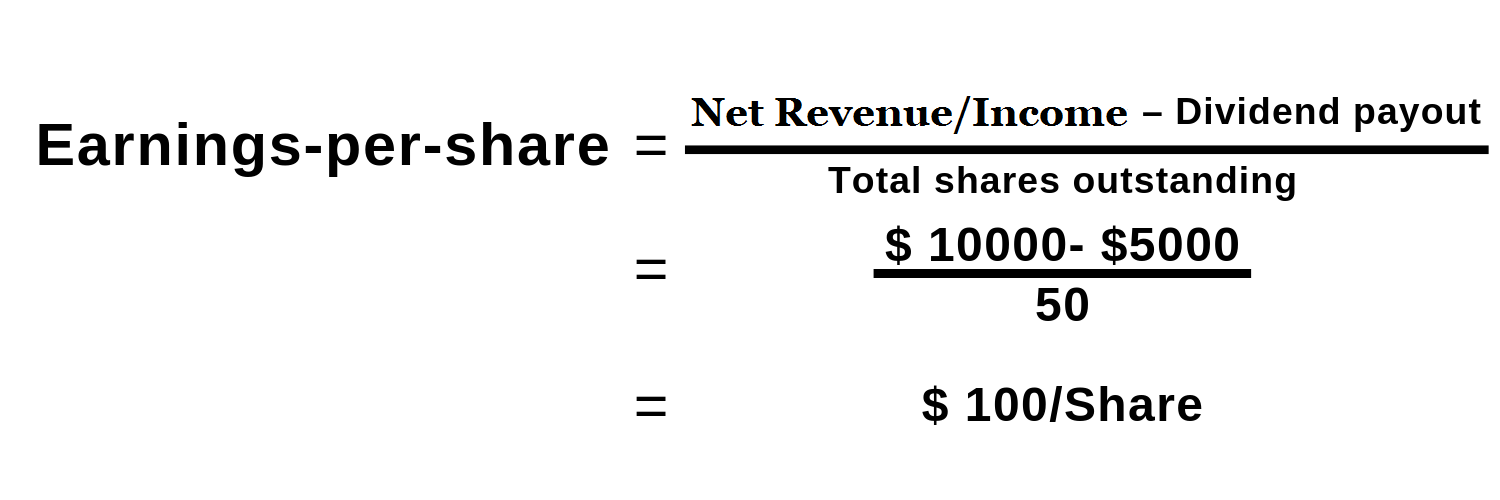

Parameter #3. Healthy dividend payout and stable Earnings-per-share

Let’s assume, a company has a net income of $ 10,000 per year. It Pays $5,000 in a preferred dividend to investors. It has 50 shares outstanding.

It is a good idea to invest your money in those stocks that regularly pay a dividend and deliver a Healthy dividend payout. The stocks which have delivered healthy dividend-paying must have the following features

- Consistent dividend payout over the past 5 years.

- The high dividend yield for the last 5 years.

- Growth in dividend per share from time to time.

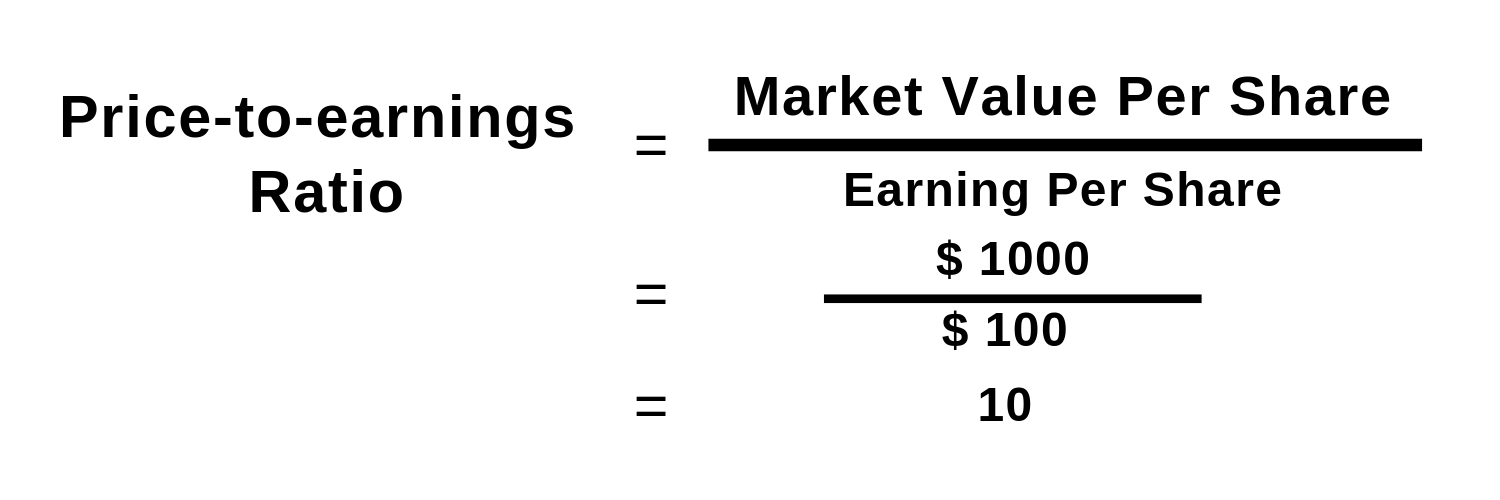

Parameter #4. Price to Earnings Ratio (P/E)

P/E ratio should be as low as compared to the other peer companies active in the same industry.

Let’s assume, a company has a net income of $10000 per year. It Pays $5000 in preferred dividends to investors. It has 50 shares outstanding.

Now, if the stock currently trades at $1000, then

You need to choose such stocks that have P/E less than 9. But P/E varies from sector to sector. Lower P/E ratio of sectors does not mean that this sector is undervalued and is going to boom and deliver a multi-bagger return in the near future compared to that sector which has a higher P/E ratio. These sectors have higher valuation just because the market is bullish on these sectors and their future potential like Automobile, FMCG, Petroleum, etc. They are the core sectors of the Indian economy and have the potential to deliver a robust performance in the upcoming years.

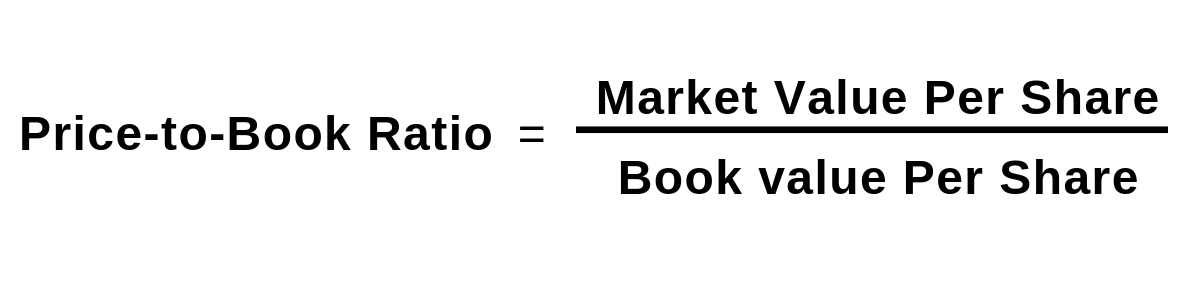

Parameter #5. Price to Book Ratio (P/B)

P/B should be low as compared to the peer companies operating in the same industry.

Let’s assume, the stock currently trades at $ 100 and the book value per share is $ 10 then,

P/B Ratio = [$100/$ 10] = 10.

You need to pick such stocks that have a P/B ratio of less than one.

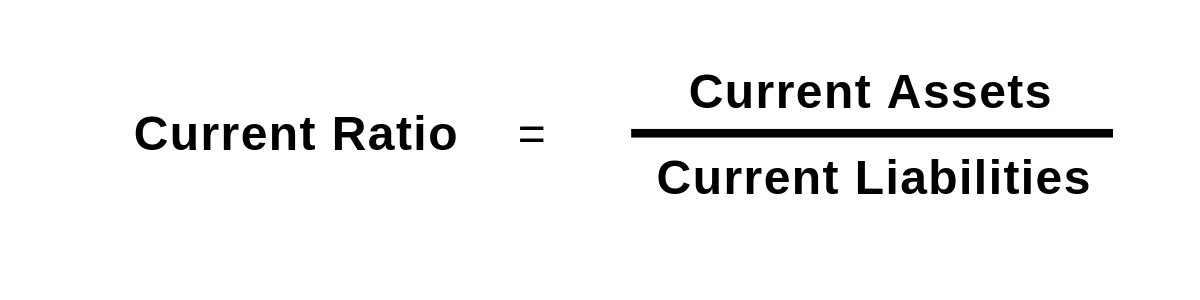

Parameter #6. Current Ratio

The ratio is the snapshot of the asset and liabilities of any company. You will find the assets and liabilities a company has in its balance sheet. Find such quality stocks that have a current ratio of more than 1.5.

Let’s assume, the current assets of any company is $ 1200 and current liabilities is $ 400 then,

Current Ratio = [$1200/$ 400] = 3.

Parameter #7. Debt to Equity Ratio

This is the comparison between a company’s own capital and the debt which the company borrows from a bank or a financial institution.

Suppose a company has a capital of Rs. 100/- and it has borrowed Rs. 100 from a bank.

So the debt ratio of the company is 100:100 = 1

A debt-free company is desirable. If not so the ratio must be low to 0.10 or 0.25.

If the company has marginal or low debt or it is a debt-free company, the company is worth investing in. Let us illustrate what is the difference between a high debt company and a debt-free company. When a company has huge debt from the market or bank or any other commercial institutions, then the company concentrates on the debt and its effort goes to pay the debt.

It cannot be sincere about the service, quality of the product, or any other important aspects needed in the business. On the other hand, if the company is debt-free, the company can concentrate on product quality, service, and customer satisfaction only. That is why a debt-free company is better than a high debt company.

Parameter #8. Return on Equity (ROE) – should be greater than 20%

Parameter #9. Dividend Yield – You can ensure about good dividend yield by the company.

Parameter #10. Beta

Beta is a measurement of the volatility of a share in respect of the market. When Beta is less than 1, it means that the share is theoretically less volatile than the market. It means the common individual may invest his money for the long term. Again, if Beta is more than 1 means that the share is theoretically more volatile than the market. For example, if a stock’s beta is 1.2, it means the stock is 20% more volatile than the market. So, a lesser beta means people are investing in that specific stock with a long-term perspective.

Parameter #11. The cash flow of the company

To understand a company’s true economic condition one should check the free cash flow of the respective company. Free cash flow actually reveals the profit the company makes. It implies a broader range in the company’s functioning in the overall business.

Whenever you check the free cash flow of a company, you should analyze from which source the company is gaining its capital for its day-to-day business. Usually, there are two sources, the first one is earning from running operations i.e., business, and the second one is receiving debt from the market i.e., debt financing.

If the company runs its operation from the profit earned by running operation you should stay invested with the company. But if the company runs its business with debt financing, naturally the debt will increase from time to time. So, stay clear of these types of companies or stocks.

Free Cash flow is one of the most reliable and widely used metrics among value investors, as it provides an accurate position of the company’s financial condition. In simple words, free cash flow is an account of how much cash a company is left with after paying for all expenses.

Companies that manage to generate consistently large cash flows without incurring much capital expenditure are always valued higher by investors. Negative free cash flows are a sign of the deteriorating health of a company.

Parameter #12. Competitive advantage

A competitive advantage allows a company to produce quality service and better prices for its customers. Then this competitive advantage accelerates the company’s sales margin which increases profit margin than its competitors i.e., peer companies.

While you invest your money in any company you should choose such a company that has a sustainable competitive advantage in respect of cost structure, brand reorganization, corporate reorganization, product quality distribution network, and superior customer support. The brand value or name of a company is in the billions of money. A portfolio of brand influences the sales and growth of the company in many ways. It is a competitive advantage over its peer companies.

Let’s understand this with an example. Whenever we talk or think about Graphic card the first name comes to our mind is GeForce RTX, GeForce GTX, QUADRO RTX, G-SYNC, etc. All these are brands of ‘Nvidia’. The products of NVIDIA possess superior quality. The company maintains a vast distribution network and superior customer service to establish this company as a market leader in the Technology Sector around the globe.

After selecting the company you need to analyze the industry or sectors in which the specific company is in operation i.e., the growth potential of the industry. A mediocre company in a growth industry can generate a better return on equity than a good company in a dying industry. You have to watch out which industry is growing and likely to deliver better Return on equity.

Top 7 Best Airlines Stocks to Buy for Long Term

The Covid-19 pandemic has changed the scenario of the economy, and during the year 2020, the bond market yield better returns than the equity market. Many companies in the airlines’ companies are under the theft of bankruptcy. But owing to the mergers and acquisitions, the four airline companies dominate 80% of the United States Market.

American Airlines Group (AAL)

This is the world’s largest airline carrier in respect of passengers on-board, and by fleet size. Since the airline industry won’t likely recover until 2022, it is a crucial time to pick an investment bet. American Airlines Group has set on a $30 billion debt, so it is a risky investment if by 2022 the airline industry does not run in its full phase. The company has recovered from its low of $11 and is now trading at $17, delivering a 66% return.

Southwest Airlines (LUV)

Southwest Airlines is not only the most popular low-cost airline carrier but also has carried the most domestic passengers in the United States. This airline started its journey between Dallas, Houston, and Sent Antonio. It is currently running its operation successfully in the United States, Mexico, Belize, Costa Rica, Cuba, The Bahamas, Aruba, Jamaica, Dominican Republic, and the Cayman Islands.

After the Covid-19 outbreak, Southwest Airlines touched its 52-week low of 22.47, but in the last 6 months, Southwest airlines have witnessed an upward movement. In the last 6 months, the stock price is surged by 56%. The airline focuses on domestic business, this will benefit in the long run. Southwest Airlines has a strong balance sheet so the upward trend is likely to continue.

Delta Air Lines (DAL)

Delta Airlines is the world’s largest airline in respect of the total number of scheduled passengers onboard. Delta Airlines runs 5000+ flights daily in 52 countries across six continents.

Though Delta Airlines reported a net loss in revenue in Quarter 2, the company has made a sharp rise after touching $24.97 in August 2020 to $42, a surge of 68%.

Though the company witnesses a deep loss, due to the intact fundamentals, the company can deliver a 48% upside within the next 3 or 4 quarters.

The company has strong liquidity of $16 billion. It is likely to trade higher from current levels in a year. The company is working on the safety of the passengers. It will give a competitive moat to attract more passengers which means more cash flow leading to push stock prices at a higher level.

JetBlue Airways Corporation [JBLU]

![JetBlue Airways Corporation [JBLU] JetBlue Airways Corporation [JBLU]](https://capitalante.com/wp-content/uploads/2020/12/Memphis-Stop-Start-Continue-Brainstorm-Presentation-48-2.jpg)

This is the 7th largest airline entity in the United States. Itused to operate over 1000 flights daily before the pandemic to various destinations within the United States and in global destinations namely Caribbean, North America, and Latin America.

Though JetBlue Airways has witnessed earnings deep, JetBlue has made a sharp recovery from its low of $9.98 to $16, a 60% upside within the last 6 months.

The company has implemented a 10-minute cleaning system to tackle the pandemic situation and will open 24 additional routes by year-end. This move will result in a sharp rise in earnings in upcoming quarters. This is Morgan Stanley’s pick that will continue its bull run in upcoming quarters too.

SkyWest [SKYW]

![SkyWest [SKYW] SkyWest [SKYW]](https://capitalante.com/wp-content/uploads/2020/12/SKYW.png)

SkyWest Airlines runs its operation through SkyWest Airlines and SkyWest Leasing. The company has over 500+ aircraft and carry over 43 million passengers across the United States of America, Mexico, Canada, and the Caribbean Islands.

SkyWest’s market cap is $1.66 billion with an EPS of $3.32. The company has generated the revenue of $2.9 billion last year.

Alaska Air Group (ALK)

Alaska Air Group operates in the segments of Airbus, Boeing, Embraer, etc. through its subsidiaries Alaska Airlines and Horizon Air.

Just like other airline carriers witnessed a deep in earnings, Alaska Air Group is not the exception. But the company is sitting on a huge cash reserve of $3.7 billion. With the strong cash reserve, the company will likely to recover from this pandemic. The company is planning to utilize the middle seat early next year, which will robust the earnings. After touching its low of $34, the stock is currently trading at $51, a 34% return within 6 months.

United Airlines Holdings

United Airlines Holdings is a company that offers satellite-based Wi-Fi to its passengers during the long duration overseas routes. The Airline provider is engaged in the transportation of people and cargo shipments to countries namely Asia, Africa, the Middle East, Europe, and Latin America.

With a whopping Revenue of $43.26B, the company has witnessed a sharp rise of 60% from its low of $19 in May 2020 owing to the corona pandemic. This stock is likely to surge because there is a spike of passengers on board as the holiday season yet to come.

Hope this article will help you to pick the best airline stocks that will yield better returns. Have a question? Make a comment so that we can have a discussion.

Buying a Property in Spain | All you need to know

Buying Land in Spain | Full Guide

https://capitalante.com/investing-in-stock-market/